Blog

Who Are Angel Investors? Relevance in 2025

Abhishek Bhanushali

Dec 8, 2025

At a Glance

Angel investors provide early-stage capital and mentorship, helping startups bridge funding gaps and validate ideas in 2025.

They move fast, offer strategic guidance, and focus on innovative sectors like fintech, healthtech, and AI.

Angel investing involves due diligence, valuation, deal structuring, portfolio diversification, and patient engagement.

Types include individual angels, super angels, syndicates, corporate angels, and family offices, each adding unique value.

Platforms like S45 Club connect investors with vetted startups, streamline deal flow, and provide guidance for strategic investing.

Disclaimer: This content is for educational purposes only and should not be considered as financial advice. Every business situation is unique, and we recommend consulting with qualified financial advisors before making important business decisions.

You’ve built an idea from scratch, assembled a small team, and maybe even launched your first product. But scaling beyond the first few customers feels like hitting a wall; funding is tight, networks are limited, and every decision matters. This is where angel investors step in.

Angel investors are individuals who provide not just capital, but mentorship and strategic guidance to startups in their formative stages. They take on higher risk than traditional investors, helping founders bridge funding gaps, gain credibility, and tap into valuable networks, giving startups the boost they need to compete and grow in a crowded ecosystem.

This blog explores who angel investors are, how they operate, their advantages, and best practices for working with them in 2025.

Who are Angel Investors?

Angel investors are high‑net‑worth individuals who provide early-stage funding to startups, often in exchange for equity or convertible debt. Unlike venture capitalists, they invest in the formative stages of a business, when risks are high but growth potential is significant.

What they do:

Provide capital: Offer the necessary funding to help startups develop products, hire talent, and reach initial milestones.

Offer mentorship and guidance: Share expertise, industry insights, and strategic advice to help founders make informed decisions.

Open networks: Connect startups with potential customers, partners, and future investors to accelerate growth.

Support credibility: Their backing signals confidence in the startup, making it easier to attract additional funding or business opportunities.

In short, angel investors are more than financiers. They act as mentors, connectors, and early partners who help startups navigate the critical first steps of growth.

Also Read: Angel Investors vs Venture Capital: Key Difference Explained

The Evolving Role of Angel Investors in Today’s Startup Economy

Angel investors are not just early backers; they are strategic enablers in a capital-tight market. With global VC funding declining compared to pre-2023 levels and investors demanding traction before commitment, angels play a critical role in providing pre-seed and seed-stage liquidity.

To put this into perspective, early-stage funding in 2023 was down more than 40% year over year, late-stage by 37%, and seed just over 30%.

In this backdrop, the agility and willingness of angel investors to take calculated risks allow startups to survive the “funding winter” and reach product-market fit.

Early-Stage Risk Capital: Angel investors are often the first external believers in a startup’s vision. They provide crucial seed funding when traditional lenders or VCs hesitate, helping founders validate their ideas and build minimum viable products.

Strategic Mentorship: Beyond funding, angels bring deep industry expertise and personal networks. Many are successful entrepreneurs themselves, guiding startups through critical decisions like pricing, go-to-market strategy, and hiring.

Focus on Innovation and Impact: In 2025, angels are not just chasing returns; they’re backing startups that solve meaningful problems in AI, sustainability, healthtech, and fintech, aligning with global innovation trends.

Faster Decision-Making: Unlike venture funds with multiple approval layers, angel investors can move fast. This agility is key for early-stage founders who need quick financial decisions to seize market opportunities.

Community-Driven Investing: Angel networks and syndicates have grown stronger, allowing individuals to pool resources and diversify risk. These communities make early-stage investing more accessible and collaborative.

In India, initiatives like S45 Club exemplify this modern angel investing model, connecting visionary investors with high-potential startups, fostering not just capital growth but lasting entrepreneurial partnerships. S45 Club also provides guidance, deal flow, and mentorship resources to help investors make informed, impactful decisions.

What Happens in Angel Investing: Everything You Need to Know

Angel investing is a high-risk, high-reward equity financing model in which individuals, typically accredited investors, use their personal capital to fund early-stage startups in exchange for ownership equity or convertible debt.

Unlike venture capitalists, who invest institutional funds, angels invest their own money and often get involved operationally to guide startup growth.

Step 1: Investment Stages and Entry Points

Most angel investors participate during the pre-seed or seed stage, when startups are still validating their product-market fit. Deals are sourced through angel networks, incubators, crowdfunding platforms, demo days, or direct outreach by founders.

Ticket sizes: In India, angel cheque sizes generally range between ₹10 lakh and ₹2 crore, depending on the investor’s experience, network, and confidence in the founding team.

Valuation methods: Common approaches include the Berkus Method, Scorecard Valuation, or Risk Factor Summation, which estimate early-stage value in the absence of revenue.

Step 2: Due Diligence and Screening

Before investing, angels conduct due diligence across:

Market potential: Investors assess TAM, SAM, and SOM to gauge scalability, favoring high-growth sectors like fintech, SaaS, and healthtech.

Team strength: Founders are evaluated for execution ability, domain expertise, and credibility, often verified through reference checks and past ventures.

Business model and burn rate: Angels review unit economics, CAC-LTV ratio, and cash runway (12–18 months) to ensure financial sustainability.

Competitive edge: IP ownership, product differentiation, and entry barriers are key to determining defensibility.

Some investors use AI-based deal screening tools or data rooms to automate the review of pitch decks, financial models, and compliance documents.

Step 3: Deal Structuring and Terms

Angel investments are typically structured via:

Equity financing (direct ownership)

Convertible notes or SAFE agreements (convert to equity in future rounds)

Terms often include anti-dilution clauses, liquidation preferences, and information rights to protect investors. Angels may also request a board observer seat to stay informed on strategic decisions.

Step 4: Portfolio Diversification

Since startup investing carries high risk, seasoned angels diversify across sectors, geographies, and founder profiles to balance risk and reward. They back multiple startups at different growth stages, some pre-revenue, others scaling, to offset potential losses.

Many collaborate through S45 Club, a trusted community that connects investors with curated, high-potential startups and provides shared diligence support. This structured diversification approach helps investors achieve steadier long-term returns while staying engaged with India’s innovation ecosystem.

Step 5: Exit Strategies and Returns

Angel investors realize returns primarily through acquisitions, IPOs, or secondary share sales once the startup reaches maturity or attracts institutional funding. Successful exits depend on strong governance, growth metrics, and investor alignment from early stages.

Angels often negotiate tag-along and drag-along rights, ensuring liquidity opportunities alongside founders or VCs. Some exits occur through structured buybacks or mergers, especially in regulated sectors like fintech or healthtech.

Achieving meaningful returns requires patience, continuous engagement with founders, and active participation in follow-on rounds to preserve equity during later funding stages.

From Super Angels to Syndicates: Decoding Investor Profiles

Angel investors differ not only in their investment size but also in their motivation, engagement level, and approach to risk. Understanding these types helps founders target the right kind of funding and mentorship for their stage of growth.

1. Individual Angels: These are high-net-worth individuals who invest personal funds, often based on domain expertise or interest. They tend to be hands-on, guiding startups through strategy, hiring, and early go-to-market execution.

Many successful entrepreneurs or CXOs turn into individual angels after an exit, leveraging their operational experience to mentor founders.

2. Super Angels: Super angels operate like micro–venture capitalists. They write larger cheques and participate in more deals per year, often leading rounds or syndicates.

Their advantage lies in their established deal flow, access to co-investors, and ability to offer structured support such as governance setup, scaling playbooks, and network introductions.

3. Angel Networks and Syndicates: Networks like S45 aggregate individual investors to collectively fund startups. Members share due diligence, risk, and post-investment monitoring.

Syndicates allow smaller investors to participate in curated deals led by experienced angels, improving accessibility and portfolio diversification.

4. Corporate Angels: These are senior executives or companies investing strategically in startups that complement their business interests. Beyond capital, they provide access to customers, data, and technology partnerships.

Corporate angels often focus on innovation-driven sectors like fintech, SaaS, and AI, where synergies with their parent companies accelerate commercialization.

5. Family Offices and Institutional Angels: Family offices and small institutional funds are increasingly participating in angel rounds. They bring professional fund management, compliance rigor, and long-term outlooks.

Their involvement provides startups with stability and credibility when raising follow-on rounds from venture capitalists.

Together, these investor types form a diverse ecosystem, from mentorship-driven individual angels to data-backed institutional investors, all fueling early-stage innovation in 2025.

Also Read: Understanding Dry Powder in Private Equity

Angel Investing: Opportunities and Risks

Angel investing can accelerate startup growth by providing early-stage capital and mentorship, but it carries inherent risks and operational challenges.

The table below summarizes the key benefits and limitations.

Advantages | Limitations |

Early-stage capital access: Enables startups to validate ideas and fund development before traditional financing is available. | High risk of failure: Most early-stage ventures fail, making angel investing inherently risky. |

Mentorship and guidance: Experienced investors provide strategic advice, industry insights, and operational support. | Equity dilution: Founders give up ownership, which may reduce control and future financial gains. |

Flexible deal terms: Angels often offer founder-friendly structures with equity or convertible instruments rather than debt. | Limited oversight: Some angels may provide minimal involvement, creating misalignment with startup strategy. |

Speed and efficiency: Deals with individual angels or small syndicates can close faster than institutional funding. | Time-intensive management: Maintaining communication and reporting with multiple investors requires effort. |

Credibility and network effects: Association with reputable angels can attract follow-on funding and enhance market credibility. | Potential conflicts of interest: Divergent goals between founders and investors can hinder strategic decisions. |

Also Read: Exit Strategy Guide for Investors: Definition and Importance

With a clear understanding of who angel investors are and the value they bring, it’s easier to see how individuals can step into this world to support startups.

Entering the World of Angel Investing

Becoming an angel investor requires more than just capital. It involves understanding early-stage markets, assessing risks, and actively supporting startups.

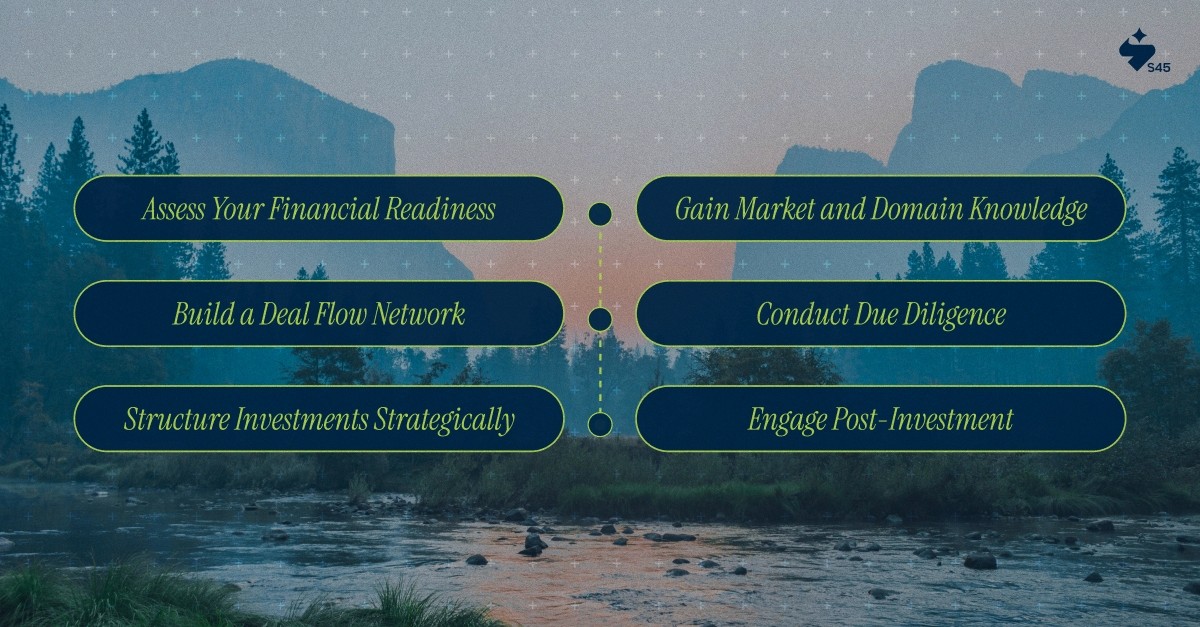

Here’s a structured approach for aspiring investors:

Assess Your Financial Readiness: Angel investing is high-risk and illiquid. Ensure you have a diversified portfolio, sufficient disposable income, and a tolerance for long-term investments. Allocate only what you can afford to lose without impacting your financial stability.

Gain Market and Domain Knowledge: Understand startup ecosystems, industry trends, and business models. Technical knowledge of sectors like fintech, SaaS, or consumer tech enhances your ability to evaluate opportunities critically.

Build a Deal Flow Network: Connect with startups via incubators, accelerators, startup events, and platforms like S45 Club. A strong deal flow ensures access to high-potential ventures and collaborative syndicate opportunities.

Conduct Due Diligence: Evaluate startups for market potential, team competency, business model viability, competitive differentiation, IP defensibility, and regulatory compliance. Some investors use AI-enabled tools or data rooms for efficiency.

Structure Investments Strategically: Decide on equity, convertible notes, or SAFE agreements. Negotiate terms such as liquidation preferences, anti-dilution clauses, and board observer rights. Consider portfolio diversification to spread risk across multiple startups.

Engage Post-Investment: Successful angels often mentor, advise, or provide strategic support. Regularly monitor performance, provide feedback, and leverage your network to assist the startup in scaling operations.

Aspiring angels can utilize platforms like S45 Club to access curated startups, streamlined deal flow, and mentoring resources, making it easier to invest wisely and maximize potential returns while mitigating risk.

Also Read: Best Alternative Investment Options in India 2025

Partner with S45: Connecting Startups with Capital

At S45 Club, we don’t just facilitate funding; we help high-potential startups access the right angel investors while ensuring they are prepared to leverage this capital for growth. Our approach combines:

Curated Investor Opportunities: We match startups with vetted angel investors whose expertise and sector interest align with the business’s growth stage and vision. This ensures funding is not just available, but strategically meaningful.

Strategic and Operational Readiness: Beyond capital, S45 helps startups strengthen governance, refine business models, and optimize operations so they can scale efficiently and attract long-term investor confidence.

Mentorship and Network Access: Startups gain access to market insights, strategic guidance, and investor networks, enabling founders to make informed decisions and accelerate growth.

For Indian startups, entering the angel investment ecosystem can be complex. With S45, businesses gain not only access to capital but also the expertise, mentorship, and operational support needed to engage investors confidently and successfully.

Connect with S45 to explore how we help startups navigate funding, due diligence, and strategic engagement with high-potential angel investors.

CTA