Get your IPO Readiness Report

In 30 minutes, turn your pitch, financials and cap table into a banker-grade IPO diagnosis with feasibility, valuation range, ideal route and a clear fix list

[ 01/06 ] · VALUE

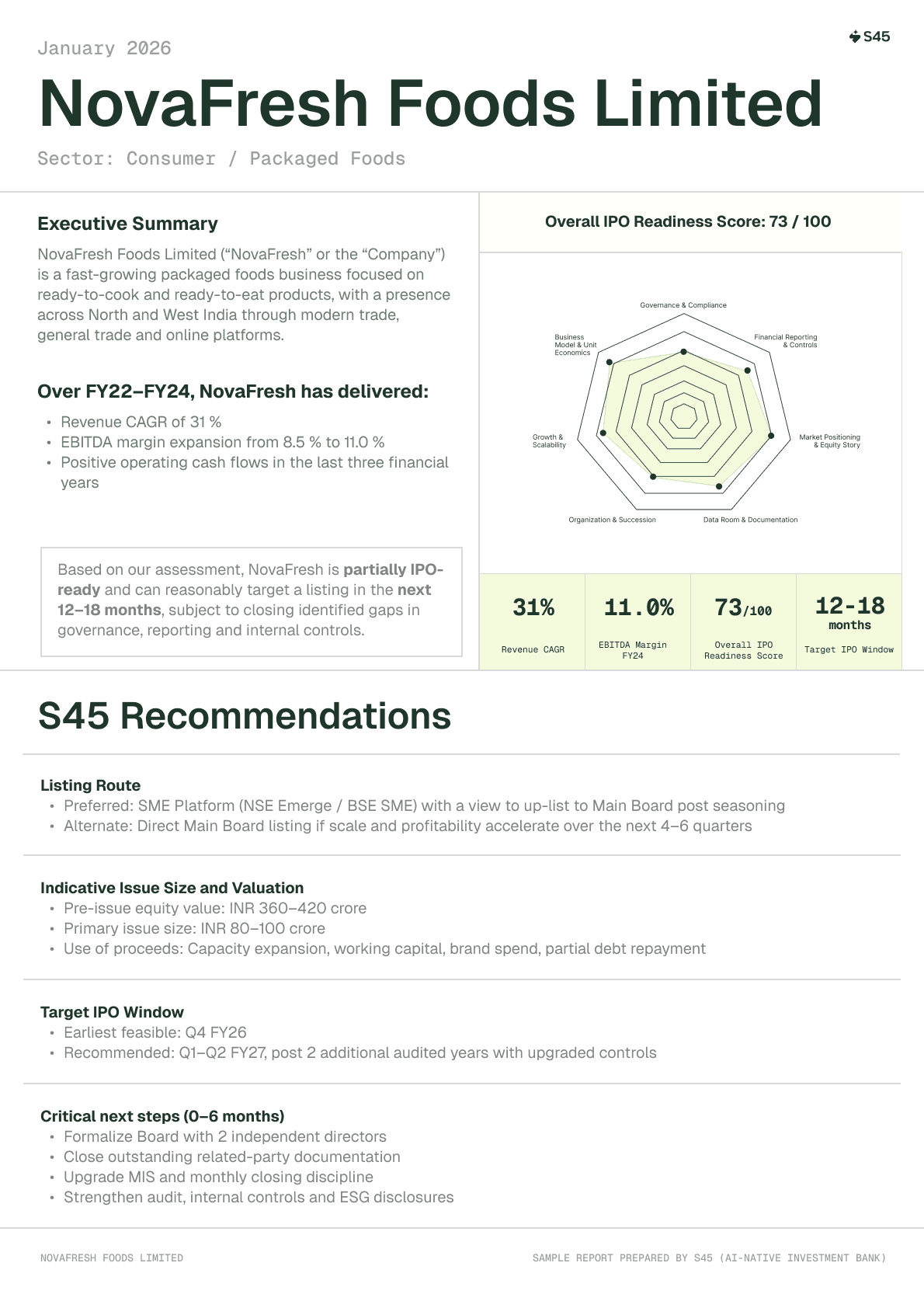

IPO Feasibility

Your IPO feasibility in the next 12–24 months

IPO Readiness Score

Route Recommendation

Recommended route: SME vs Main Board, book built vs fixed price

Key Gaps

Key gaps to fix before engaging bankers, exchanges or regulators

[ 02/06 ] · PREREQUISITES

Are considering an IPO in the next 1 to 2 years

Want a clear yes/no and “what to fix” before hiring multiple advisors

People who're not even aware their company is IPO-abled

Care about alignment across story, numbers and governance before going public

If that’s you, this Readiness Score isn’t “nice to have.” It’s how you start the IPO process correctly.

[ 03/06 ] · WHAT'S INSIDE

Readiness Score

Readiness Score with red/amber/green flags

Route Recommendation

Route recommendation (Main Board vs NSE Emerge/BSE SME) with float math

Size & Band

Indicative raise range and sensitivity (data permitting)

Fix List

Fix-list across governance, disclosure, controls, contracts

Timeline to DRHP

Timeline to DRHP and listing with critical path

Investor Map

Investor map starter (anchor archetypes)

If documents are insufficient to produce the report, we flag gaps and refund ₹13,449 instantly

[ 04/06 ] · SAMPLE REPORT

[ 05/06 ] · YOUR REPORT

IPO Readiness Report

[ 06/06 ] · TRUST

Your Data is Always Protected

DATA ENCRYPTED

YOUR DEAL TEAM

7 DAY DELETION

MUTUAL NDA

CTA