Blog

What Are Private Equity Firms? A Simple Guide for 2025

Abhishek Bhanushali

Dec 8, 2025

At a Glance

Private equity firms invest in established companies, enhancing value through operational and financial improvements before exit.

Private equity in 2025 emphasizes operational value creation, AI-driven diligence, sector convergence, and strategic growth in underserved markets.

Deal types include buyouts, growth equity, late-stage VC, distressed assets, and thematic funds targeting ESG or digital transformation.

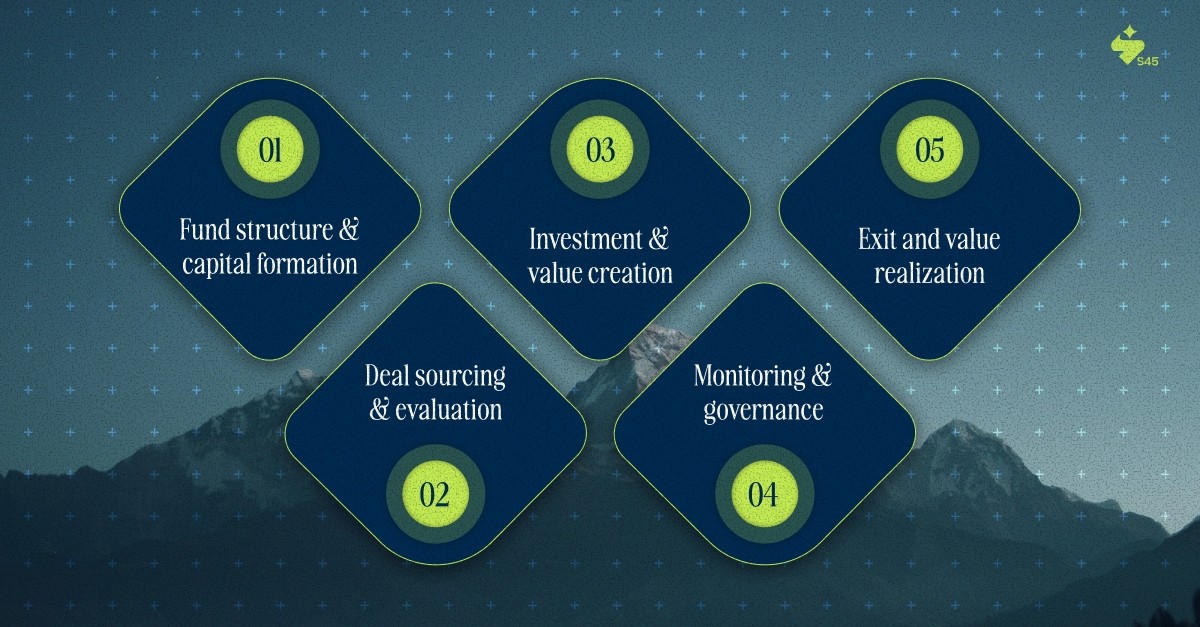

PE firms create value via fund structuring, deal sourcing, operational improvements, governance, and carefully planned exits.

S45 Club bridges investors with scalable MSMEs, combining PE discipline with accessibility, regulatory guidance, and operational support.

Disclaimer: This content is for educational purposes only and should not be considered as financial advice. Every business situation is unique, and we recommend consulting with qualified financial advisors before making important business decisions.

You’ve built a business from the ground up. Revenue is crossing ₹100 Cr, margins are steady, and growth is accelerating, but the next big leap feels out of reach. Traditional funding options like bank loans or incremental debt won’t get you there, and bringing in strategic partners seems daunting.

That’s where Private Equity (PE) firms come in. Unlike venture capital, which backs risky startups, PE firms invest in established businesses ready for scale, operational transformation, or a market edge, injecting not just capital, but expertise to fuel exponential growth.

This blog explores what private equity firms are, how they operate, their investment strategies, and why they remain key drivers of business transformation in 2025.

What are Private Equity Firms?

Private equity (PE) firms are investment organizations that pool capital from institutional investors, high-net-worth individuals, and sometimes family offices to acquire stakes in private or occasionally public companies.

Their goal isn’t just to invest money, but to actively enhance the value of the businesses they back.

Typically, a PE firm will:

Raise a dedicated fund of capital for investments.

Acquire or take control of companies that are established but need growth capital, operational improvements, or restructuring.

Work closely with the management team to optimize operations, implement strategic initiatives, introduce new technology, and improve governance.

Plan a profitable exit after a few years, through a sale, merger, or public listing, delivering returns to both the investors and the company itself.

In essence, PE firms combine financial resources with strategic guidance to transform companies into stronger, more profitable, and scalable businesses.

Also Read: Angel Investors vs Venture Capital: Key Difference Explained

Why Private Equity Firms Matter More Than Ever in 2025

Private equity activity surged in Q3 2025, with deal value reaching a record 25.73 lakh crore (US$310b) as firms are leaning into a window of opportunity in the M&A markets.

As markets evolve and traditional financing models face increasing pressure, private equity (PE) firms are stepping in with fresh strategic value-creation models rather than simply buying assets.

In 2025, they are not only sources of capital but also active partners that can reshape businesses, accelerate digital transformation, and unlock long-term growth.

Key relevance factors include:

Operational value-creation focus: PE firms are increasingly emphasising hands-on improvements, transforming operations, boosting efficiency, and accelerating growth, rather than relying solely on financial engineering.

Sector convergence and new frontiers: They are targeting sectors where traditional industry boundaries blur, such as technology & infrastructure, healthtech & consumer services, and creating opportunities in these “nexus” areas.

AI and advanced analytics adoption: With data and AI moving from experimentation to execution, PE firms are using intelligent tools for deal-sourcing, diligence and portfolio management, and improving decision-making and return potential.

Secondary and continuation market activity: With some exits delayed and buy-out activity shifting, PE firms are increasingly using secondary deals and continuation funds to provide liquidity and maintain exposure to high-potential assets.

Resilience amid market uncertainty: Despite macro-headwinds such as high interest rates, geopolitical risk, and slower M&A, PE firms are leveraging their long-term horizons and structural advantages to capitalize on dislocations, distressed assets, and underserved markets.

In short, private equity is not just a funding source; it’s a strategic growth engine for businesses that need capital and operational expertise to thrive.

But what if you lack the access and governance structure to attract institutional PE? This is precisely why S45 Club exists: to bridge this gap by curating and structuring deals for high-potential MSMEs. We enable you to access the strategic capital, regulatory insights, and long-term growth playbooks needed to transform your local leadership into an enduring, scalable enterprise.

Also Read: How to Create Effective Angel Investor Contracts

Types of Private Equity Deals and What They Mean

Private equity (PE) firms vary widely in strategy, sector focus, and deal structure. Their specialization determines how they generate returns, manage risk, and create enterprise value.

In 2025, PE strategies have become more nuanced, blending traditional buyouts with data-driven, impact-focused investments:

1. Buyouts (Leveraged and Management Buyouts)

Buyouts remain the cornerstone of PE activity.

Leveraged buyouts (LBOs) involve acquiring controlling stakes using a mix of debt and equity, with the acquired company’s cash flow servicing the debt.

Management buyouts (MBOs) see existing management teams acquiring ownership with PE backing, ensuring operational continuity.

In India, mid-market buyouts are growing as family-owned businesses seek professionalization without full exits.

2. Growth Equity

Growth equity focuses on scaling established but fast-growing companies without taking full control.

Typically targets profitable or near-profitable firms needing capital for expansion, technology upgrades, or new market entry.

Investors negotiate minority stakes but secure governance rights and performance milestones.

2025 has seen increased growth deals in sectors like healthtech, SaaS, and manufacturing digitization.

3. Venture Capital (VC) and Late-Stage Investments

While technically distinct, many PE funds now operate late-stage VC arms.

These deals provide liquidity bridges between Series C–E funding rounds and pre-IPO stages.

Firms use predictive analytics to assess scalability, retention, and burn ratios.

The trend aligns with India’s maturing startup ecosystem, where PE and VC lines are increasingly blurred.

4. Distressed and Special Situations

Special situation funds target underperforming or distressed assets.

Investments may include debt restructuring, turnaround financing, or acquiring stressed assets under the Insolvency and Bankruptcy Code (IBC).

These deals demand operational expertise and deep sectoral knowledge to restore value.

With rising global rate pressures, such strategies are gaining traction across Indian manufacturing and infrastructure.

5. Sector-Focused and Thematic Funds

PE specialization is shifting toward thematic investing, where funds focus on ESG, sustainability, and digital transformation.

Funds now deploy AI-driven diligence tools to identify climate-positive or automation-ready companies.

Thematic funds in India increasingly align with government initiatives like “Make in India” and “Digital India,” focusing on long-term macro value creation.

Private equity’s specialization today lies in precision, targeting specific growth levers, operational efficiencies, and societal impact rather than broad acquisitions.

How Private Equity Firms Create Value

Private equity firms function through a defined investment cycle, raising capital, acquiring promising businesses, improving them operationally and financially, and finally realizing gains through exits.

What differentiates successful firms is not just access to capital, but how effectively they build and execute value creation plans.

1. Fund structure and capital formation: PE firms raise capital from Limited Partners (LPs), including pension funds, family offices, and institutional investors, into a structured fund managed by the General Partner (GP).

Each fund typically runs for 7–10 years, during which committed capital is drawn down in phases as investments are made. The GP earns a management fee and a share of profits (carried interest), aligning incentives with investors.

2. Deal sourcing and evaluation: The ability to identify the right opportunities defines a firm’s edge. PE firms rely on banker networks, market intelligence, and sector expertise to source deals.

Every prospect undergoes deep financial modeling, due diligence, and risk assessment to validate growth potential. Increasingly, firms deploy data analytics and predictive modeling to evaluate performance metrics like EBITDA expansion or margin resilience before investing.

3. Investment and value creation: After acquisition, firms collaborate closely with management teams to strengthen operations and drive growth. This may include restructuring leadership, improving supply chains, expanding into new markets, or adopting digital transformation strategies.

A well-defined value creation plan (VCP) sets the performance roadmap, ensuring measurable impact on profitability and scalability.

4. Monitoring and governance: Active ownership is central to PE success. Firms maintain board representation, review quarterly performance, and ensure compliance and transparency.

Modern governance now extends to ESG and sustainability metrics, aligning portfolio performance with responsible investment standards.

5. Exit and value realization: Once strategic goals are achieved, PE firms exit through trade sales, secondary buyouts, or public offerings.

The goal is to realize returns that reward both LPs and GPs while maintaining the company’s long-term stability post-exit.

Also Read: Understanding Dry Powder in Private Equity

While private equity offers significant growth opportunities, navigating its structured processes and rigorous expectations can be challenging for MSMEs. Next, let's look at some of the common advantages and drawbacks of private equity funding.

Understanding the Trade-Offs of Private Equity Funding

Private equity firms have become essential growth catalysts for established and emerging enterprises, providing capital, operational expertise, and strategic direction. Yet, the same rigor that drives transformation can also create challenges around ownership, agility, and long-term autonomy.

The table below summarizes the core advantages and limitations of partnering with private equity investors:

Advantages | Limitations |

Strategic capital infusion: PE firms deploy substantial funds to support expansion, M&A, or restructuring initiatives. | Ownership dilution: Founders often give up majority control or board influence. |

Operational excellence: Investors implement data-driven management systems, cost optimization, and process standardization. | Pressure for returns: PE timelines can prioritize short-term profitability over innovation or experimentation. |

Long-term partnership: PE capital is typically committed for multiple years, enabling stability and growth planning. | Limited eligibility: PE is largely accessible to mid- or late-stage companies with consistent revenue. |

Enhanced governance: PE-backed firms benefit from stricter compliance, reporting, and board oversight. | Complex negotiations: Legal, financial, and performance due diligence can be resource-intensive. |

Global credibility: Association with top-tier PE firms can elevate brand reputation and open cross-border opportunities. | Exit alignment: Differing views on exit timing or valuation can create founder–investor friction. |

S45 Club bridges the best of both worlds, offering the strategic discipline of private equity while preserving founder vision.

Also Read: Exit Strategy Guide for Investors: Definition and Importance

Partner with S45: Unlocking Growth Opportunities for MSMEs

At S45, private equity is about creating intelligent pathways for MSMEs to scale, professionalize, and participate in India’s structured investment ecosystem.

1. Curated Access to Growth Capital: Using our proprietary sourcing and screening model, S45 connects MSMEs with investors aligned to their sector, growth stage, and operational readiness.

This ensures businesses receive capital from partners who understand their vision and can support structured expansion.

2. Strategic and Regulatory Support: S45 guides MSMEs through SEBI-regulated frameworks, including Category I and II AIFs, helping them navigate term sheets, compliance, and exit planning with clarity.

This structured approach reduces regulatory friction and positions MSMEs for sustainable partnerships.

3. Operational Value Creation: Beyond capital, S45 helps MSMEs strengthen operational levers, improving manufacturing efficiency, implementing innovation, and adopting data-driven decision systems.

This builds resilient businesses capable of long-term growth and measurable performance improvement.

Our goal is simple: make private equity accessible, transparent, and outcome-oriented for India’s MSME ecosystem.

Connect with S45 to explore how we help MSMEs secure capital, enhance operations, and engage strategically with high-potential investors.

CTA